Ach Processing Can Be Fun For Everyone

Table of ContentsThe Definitive Guide to Ach ProcessingGetting My Ach Processing To WorkThe 6-Second Trick For Ach ProcessingThe Basic Principles Of Ach Processing

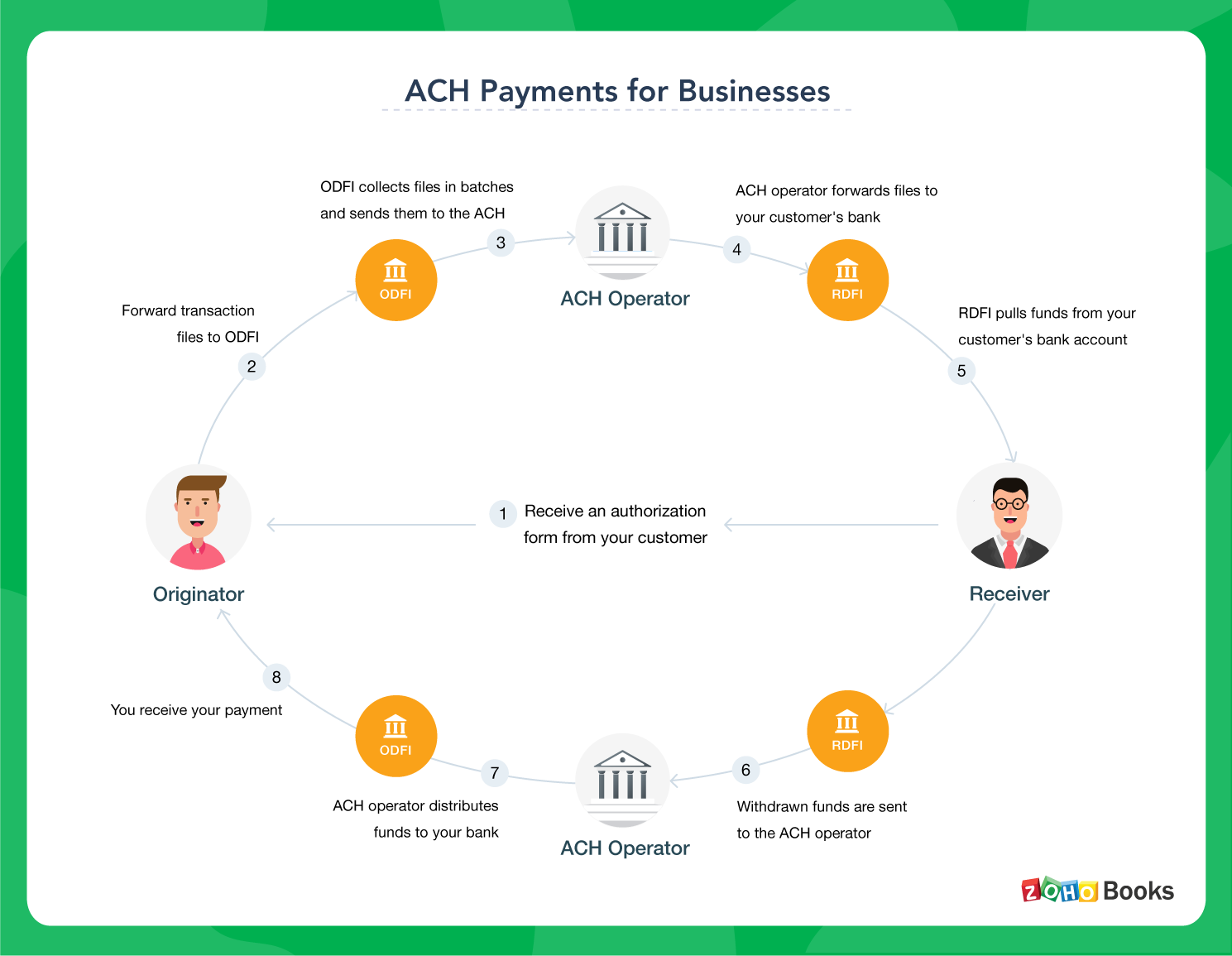

More lately nonetheless, financial institutions have come to enable exact same day ACH settlements or next-day ACH transfers that take only one to 2 business days. As lengthy as the digital settlements request is submitted prior to the cutoff for the day, it's feasible for the money to be gotten within 24 hours.Regardless of what kind of ACH payments are involved, a transfer is a procedure of 7 actions, which begins with the cash in one account as well as finishes with the money arriving in an additional account. ACH repayments start when the pioneer (payer)starts the procedure by requesting the purchase. The producer can be a customer, business, or a federal government firm.

As soon as a transaction is launched, an entry is submitted by the financial institution or repayment processor managing the initial stage of the ACH payments procedure. The bank or payment processor is called the Originating Vault Financial Institution (ODFI). Monetary establishments frequently send out ACH entries in sets, normally 3 times a day throughout normal organization hrs.

Reserve bank as well as the EPN are national ACH drivers. Once obtained, an ACH driver sorts the set of entrances into deposits and settlements, and also repayments are then sorted into ACH credit as well as debit settlements. This guarantees that cash is transferred in the right direction. After arranging access, the ACH driver sends them to their predestined financial institution or monetary organization, referred to as a Getting Depository Financial Establishment (RDFI).

Getting The Ach Processing To Work

Ultimately, when obtaining ACH payments, the obtaining financial establishment either credit histories or debits the receiving checking account, depending on the nature of the transaction. While the overall expense connected with accepting ACH payments differs, ACH fees are usually much cheaper than the charges connected with approving card payments. One of the biggest cost-influencers of approving ACH repayments is the quantity of deals your business intends to process.

Whether you're an acquirer, repayments cpu or vendor, it's vital to be able to obtain total real-time visibility into your payments ecological community. Improperly executing systems increase irritation throughout the whole settlements chain. It can lead to long lines up, the chance of customers abandoning acquisitions, as well more as discontentment from customers significantly affecting income.

IR Transact streamlines the complexity of taking care of contemporary settlements environments, consisting of ACH settlements. Bringing real-time presence and settlement tracking to your entire setting, Negotiate uncovers exceptional insights into ACH deals and also settlements fads to assist you simplify the payments experience, transform data right into intelligence, as well as assure the payments that keep you in business.

See This Report on Ach Processing

When you move cash to your close friend's account, ever before wondered exactly how it works? What really happens behind the scenes? Opportunities are you have currently used ACH payments, but are not accustomed to the jargon. Some of the examples of ACH transactions include: Online costs settlements via your checking account, Moving money from one checking account to one more, Paying vendors or obtaining cash from customers via direct down payment, Straight deposit payroll to a worker's bank account made use of by business, Allow's check out ACH payment refining extra carefully.

, ACH repayments per day exceeded 100 million in February 2019. 1% rise in ACH transaction quantity for the first quarter of 2020, with B2B settlements posting an 11.

You transfer cash to a Silicon Valley Financial institution account from your Financial institution of America account. Both the financial institutions have to credit report and also debit each various other's accounts.

In this manner, the fund transfer happens simply as soon as. ACH is one such main clearing up system for financial institutions in the United States. It operates through two clearing centers: the Reserve bank and also The Clearing up Residence. Cord transfers are interbank electronic repayments. While wire transfers seem to be comparable to ACH transfers, right here are some vital differences in between them: Can take a few service days, Instantaneous, Free for a receiver, small costs ($1) for a sender, Both the sender as well as receiver are billed costs.

Some Known Questions About Ach Processing.

Can be challenged if problems more information are satisfied, Once initiated, can not be canceled/disputed, No human treatment, Typically entails financial institution staff members, Both send and ask for repayments. For payment demands, you require to post the ACH file to your bank.

Your consumer licenses you to debit their savings account on his behalf for persisting purchases. Allow's claim Jekyll needs to pay a sum of $100 to Hyde (presume they're 2 various people) and also chooses to make an electronic transfer. Below is a step by action break down of how a bank transfer through ACH jobs.